How Much Backpay Will I Receive

SSD

You will receive back pay based on what is called your “entitlement date.”

For SSD, your entitlement date is generally five full months after your “date of disability onset” or twelve months before the date you submitted your application, whichever is later.

Social Security will determine the date of onset of your disability based on the medical evidence the agency has collected about you from your doctors and from hospitals that have treated you. Having to wait five months before getting any benefits basically means your first five months of benefits are withheld.

SSI

For SSI benefits, even if your disability began before you applied for benefits, your official date of onset will be sometime after the date you applied. This is because no benefits are paid to SSI recipients for periods before an application for benefits was submitted. Your back payment will be paid from the month after your application date through the date benefits are awarded to you.

Your Disability Payment Is Based On Your Average Lifetime Earnings Before You Became Disabled The Severity Of Disability Does Not Factor In Although Payments From Other Sources Can

Unlike Supplemental Security Income , which also pays benefits to people who are disabled and unable to work but is based on limited income and resources, SSDI requires that you have worked and paid Social Security taxes for a certain length of time.

The average SSDI payment is currently $1,277. The highest monthly payment you can receive from SSDI in 2021, at full retirement age, is $3,148. This article covers how the monthly benefit is calculated.

For More On How To Calculate Social Security Disability Benefits Call An Ssdi Attorney Today

Social Security disability law is complicated, which is why it is the only kind of law we practice at Troutman & Troutman, P.C. We have years of experience with SSDI and SSI claims, so we can answer any other questions you may have. In particular, we can explain how the SSA will calculate Social Security disability benefits in Oklahoma.

Every Social Security disability claim is different, so our Tulsa disability lawyers will give you the personalized attention you deserve. Call us today to schedule a free consultation.

Point of Interest

Recommended Reading: Military Retirement Points Calculator

Special For Adult Disabled Children

For a parent awarded SSD benefits for their adult disabled child, meaning a child over age 18, different rules apply. There is no five month waiting period. However, complex rules determine the “entitlement date.” You may need the assistance of an attorney to understand the benefits your adult child is entitled to.

For disabled parents, back pay for their adult disabled child will not go back any further than 12 months before the parent applied for benefits. If the child does not become disabled until after age 18, the earliest benefit date will be the first full month after the adult child is disabled.

Social Security Disability Evaluation Process

While there are some conditions that the Social Security Administration considers so severe that they automatically render an applicant disabled, many conditions require careful screening, including answering these five questions:

In addition, qualifying conditions must be expected to last at least one year or result in death.

Recommended Reading: Is Ssdi Taxable In California

How To Apply For Va Disability Benefits

The Department of Veterans Affairs recommends eligible Veterans apply for disability compensation benefits through the VA’s eBenefits online portal. However, Veterans may also apply by mail with VA Form 21-526EZ, in person at your regional benefits office, or with help from a trained professional.

In any case, you will need access to your DD214 , the medical evidence of the disability, and dependency records .

If you have yet to separate from service, you may still apply using the Benefits Delivery at Discharge program. To be eligible for the BDD, you must:

- Be on full-time active duty , and

- Have a known separation date, and

- Your separation date is in the next 90 to 180 days

If you have less than 90 days until separation, you may still file a fully developed or standard claim.

How Does Social Security Determine If I Am Disabled

After you submit your application for Social Security disability benefits, Social Security will gather your medical records and evaluate whether you are disabled through numerous criteria including your prior work experience, age, health problems, and education. Social Security then determines if you are able to do your past work and if not, what jobs you can do in the economy.

You May Like: Can You Get Disability For Copd

Don’t Miss: Is A Food Allergy Considered A Disability

Who Is Entitled To Va Compensation For Medical Issues

Veterans who apply for VA disability compensation must have medical conditions that are the result of an injury or disease that was incurred or aggravated while on active duty or active duty for training; or from injury, heart attack, or stroke that occurred during inactive duty training.

VA guidelines state that such disabilities may apply to medical conditions such as Lou Gherigs Disease, mental health issues including Post-Traumatic Stress Disorder, and more. All medical claims submitted to the VA will be reviewed for determining the nature and severity of the condition as well as whether the condition is deemed by the VA to be service connected.

What To Do If You Earn More Than The Social Security Earnings Limit

Let me say that the Social Security Administration will only contact you by official mail through the United States Postal Service. Unless you initiate phone communication, they will never call you. Having said that,; please understand that all of the examples I share come from communications by mail.

You dont have to do anything in advance if you work while collecting benefits and expect to exceed the annual earnings limit.

Yes, the Social Security Administration wants you to advise them in advance. However, that isnt always practical for various reasons. You will not be penalized or pay extra for waiting until you are certain how your particular circumstances develop.

When Social Security receives your W2s and tax returns, they will evaluate your account and make adjustments accordingly.

Also Check: Disability For Degenerative Disc Disease And Fibromyalgia

How Much Does Permanent Disability Pay

Home » Frequently Asked Questions » How Much Does Permanent Disability Pay?

There is a complex formula used to determine how much you draw from Social Security Disability Insurance . In general, most people get between $700 and $1,700 each month. According to the Social Security Administration;, the average monthly payout for qualified individuals is $1,197 for 2018. Those who earned a high income during their years working could get as much as $2,788 per month in benefits.

At Berger and Green, our disability lawyers;can help you understand how much permanent disability pays. We can discuss how to qualify;for benefits during a free consultation. Call us at to get started.

Special Rules For Disabled Widow

If you are a disabled widow, the date you begin to receive benefits depends on whichever of the following happens last:

- 12 months before the date you applied

- five months after the “date of onset” of your disability

- the month your spouse died, or

- the month you turn 50.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Also Check: Can You Get Disability For Generalized Anxiety Disorder

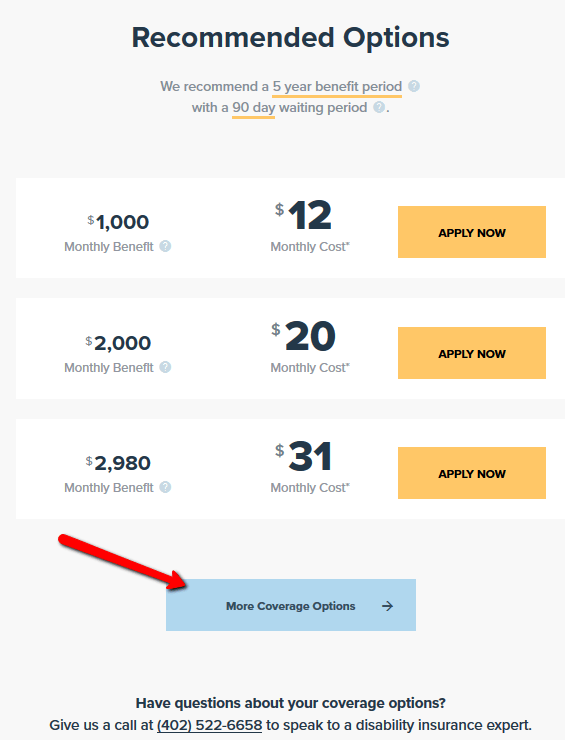

How Much Does Long

In most cases, a long-term disability insurance policy costs 1-3% of your annual salary. Actual premiums vary for each individual, but long-term disability is the most cost-effective form of income protection you can get.

The chart below shows how much you might pay for coverage based on a pre-tax income of $15,000 to $200,000 per year.

| Annual Salary |

|---|

How Much Is 100 Percent Va Disability Per Month

Home » FAQs » How Much Is 100 Percent VA Disability Per Month?

As of December 1, 2019, a 100 percent VA disability for a single veteran with no dependents is $3,106.04 per month. The U.S. Department of Veterans Affairs adjusts this amount each year, typically raising it to account for increases in the cost of living. In addition to your base monthly compensation, you may also be eligible for additional money on behalf of dependents living in your household. This includes your spouse, children, or dependent parents.

A 100 percent schedular rating signifies a total disability. In order to receive benefits at this level, you must submit compelling evidence of a disability sufficient to meet the 100 percent criteria as established by the VA for your condition or have multiple service-connected conditions that combine to 100 percent. A VA disability lawyer can help you with this. For a free case evaluation, call .

You May Like: Is Benign Intracranial Hypertension A Disability

Our New Mexico Social Security Disability Lawyers In Roswell Take Care Of The Details

In addition to insufficient medical evidence, a great many applications are rejected in what is known as a technical denial. A technical denial means that a disabled person was denied benefits not based on medical reasons but because they did not meet some other standard for the program. This could be as simple as incorrect paperwork or involve larger issues, such as high earnings or lack of work experience.

At The Injury and Disability Law Center, our legal team ensures that all the details of your case are handled properly, so you can focus on getting back to your normal life without the worry of lost benefits. While we handle cases at every stage of the process, its best to seek legal help right from the start. Our legal team will:

- Gather evidence

- Answer questions

- State your case at a hearing if necessary

Our attorneys Jeremy Worley and Josh Worley have a combined 25;years experience, and weve helped more than 1,000 clients seek the benefits they deserve. In addition, we work on a contingency fee agreement, which means we are only paid once your case is successfully resolved. Hiring the right disability attorney can be difficult, especially when there a hundreds of lawyers claiming they can help get you the benefits you need.;

Can You Get Ssdi And Ssi At The Same Time

In some cases, a disabled worker may receive payments from both the SSD and SSI programs. Typically, they qualify for SSD, but because they made very little over a short work history, even with SSD they have the financial need that makes them eligible for SSI. Receiving both SSD and SSI is referred to as concurrent benefits.

When the Social Security Administration considers your application for SSD or SSI, it will determine whether you qualify for concurrent benefits, depending on your income and assets.

In addition to more in your monthly check, having SSI in addition to SSD makes you instantly eligible for Medicaid. An SSD recipient qualifies for Medicaid two years after they become eligible for SSD. Both SSI and SSD recipients are also eligible for Medicare, which covers fewer services, but which more doctors accept.

Determining which benefits you qualify to receive, instead of just hoping some overworked SSA claims examiner gets it right, requires a thorough understanding of the SSD and SSI programs and accompanying law. Our attorneys have that knowledge as well as the commitment required to make sure you obtain the full benefits that you are entitled to by law.

Recommended Reading: Reserve Retired Pay Calculator

Calculating Your Ssi Payment

Here is an example of how the SSA takes into account your income in calculating your SSI payment. Let’s say Maria makes $625 per month from a part-time job, before taxes. Because the SSA won’t count the first $20 of any income per month, or the first $65 of earnings, this leaves Maria’s countable income at $540 . Finally, the SSA doesn’t count half of Maria’s remaining earnings, or $270 in Maria’s case. So, out of the $623, the SSA only counts $270 as countable income and will subtract $270 from Maria’s SSI payment. Maria’s monthly payment will be $524 .

Talk To A Social Security Disability Attorney For Free

Social Security Disability lawyers John Foy & Associates never charge you a thing unless we win your case. And with more than 20 years of experience helping Social Security Disability applicants win the benefits they need, we know what the SSA is looking for. Let us give you a FREE consultation to discuss your case and how we can help. To get started today, call us at , or complete the form to the right for your free consultation.

You May Like: How Much Is Disability In Ca

Also Check: Short Term Disability For Alcoholism

Is Your Condition Found In The List Of Disabling Conditions

For each of the major body systems, we maintain a list of medical conditions that we consider severe enough that it prevents a person from doing substantial gainful activity. If your condition is not on the list, we have to decide if it is as severe as a medical condition that is on the list. If it is, we will find that you are disabled. If it is not, we then go to Step 4.

We have two initiatives designed to expedite our processing of new disability claims:

- Compassionate Allowances: Certain cases that usually qualify for disability can be allowed as soon as the diagnosis is confirmed. Examples include acute leukemia, Lou Gehrigs disease , and pancreatic cancer.

- Quick Disability Determinations: We use sophisticated computer screening to identify cases with a high probability of allowance.

For more information about our disability claims process, visit our Benefits For People With Disabilities website.

How To Apply For Eia

For more information on how to apply for EIA, contact your local EIA office.

Phone: 204-948-4000 in Winnipeg

After-hours emergency support may be available if you have a crisis that cannot wait until regular business hours. For emergency support, call 204-945-0183 in Winnipeg or toll free at 1-866-559-6778.

Don’t Miss: Borderline Personality Disorder Social Security Disability

Is It Better To Get A Lawyer For Disability

Studies have shown that claimants who are represented by a lawyer are three times more likely to have their disability claim approved and be awarded disability benefits. An attorney will take the case on a contingency basis, so you will not have to pay anything out of pocket. Most disability claims are denied.

How Much Will My Disability Check Be

How much your monthly disability check will be depends on whether you’ll receive Social Security Disability or Supplemental Security Income . SSD is for workers who are insured under the Social Security retirement system. SSI is for low-income persons with disabilities.

SSD

Your SSD check will be based on the average amount of money you earned during your life before you became disabled. Whenever Social Security, or FICA, taxes were withheld from your pay, your earnings will count when calculating your SSD benefit. Similarly, if you paid self-employment taxes on income from a business, those earnings count toward your SSD benefit. But Social Security won’t count any income towards your average you earned that you didn’t pay Social Security taxes on.

For a quick view of your lifetime earnings, you can check your Social Security Earnings Statement. To do this, register for my Social Security Online. Or you can call or visit your local Social Security office to ask for help.

Social Security applies a formula to your average lifetime earnings to calculate the amount of your monthly check. The average SSD payment is currently $1,277. The highest dollar amount you can receive from SSD monthly in 2021 is $3,148.

SSI

The SSI program pays a maximum benefit of $794 a month if you are single or $1,191 a month for a couple in 2021. This is the total amount you are eligible to receive, but it will be reduced by certain other benefits or income you may receive.

You May Like: Fibromyalgia Long Term Disability