Get Ssa Benefits While Living Abroad

U.S. citizens can travel to or live in most, but not all, foreign countries and still receive their Social Security benefits. You can find out if you can receive benefits overseas by using the Social Security Administrations payment verification tool. Once you access the tool, pick the country you’re visiting or living in from the drop-down menu options.

How The Direct Express Card Works

As mentioned above, DE is for federal benefits, and not only those you can get through the Department of Veterans Affairs. Using this card, you can receive benefits including but not necessarily limited to:

- Social Security

- Supplemental Security Income

- Veterans assistance

According to the Treasury Department official site, more than four million beneficiaries of Social Security and SSI do not have bank accounts. Signing up for Direct Express means any benefits you are entitled toSocial Security, Supplemental Security Income, VA payments, or other federal benefitsget automatically deposited in the users account on the scheduled payment date.

» MORE: Check your VA home loan eligibility with today’s top lenders

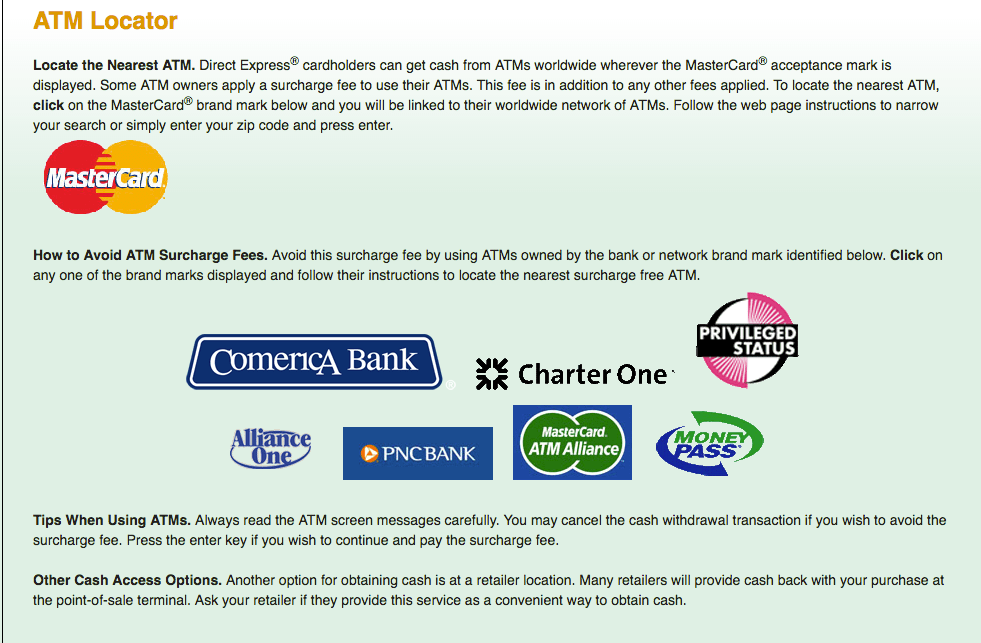

One user-friendly aspect of the Direct Express® card? Cutting out usage fees. There is no cost to sign up for the program, there are no monthly fees, and according to the official site, While there are fees for some optional transactions, it is possible to use the card for free using free cash back options with purchases, or free cash withdrawals through bank or credit union tellers, according to the official site.

Direct Express users also get one free ATM cash withdrawal in the United States for each benefit payment deposit posted onto an account.

Paperwork Reduction Act Notice

This collection of information is authorized by OMB Control No. 1510-0007. The estimated average time associated with filling out a paper direct deposit enrollment form is 10 minutes per respondent or record keeper, depending on individual circumstances. The estimated average time for completing a direct deposit enrollment online is approximately five minutes.

Don’t Miss: Do You Pay Taxes On Disability Payments

How Can You Get Direct Express Emergency Cash

As you may expect, you cannot simply enter a PIN at store registers and purchase things without a card. This may sound inconvenient, but it is actually a good thing. The aforementioned system would be extremely insecure and could lead to your account being compromised.

If you lose your card or are waiting for one to come in the mail for any reason, you will need to obtain your funds in the form of cash. You can get up to $1000 in your account, but it needs to be a cash payment.

But where can you get this cash?

The most common location is a MoneyGram facility within your local Walmart. Nearly all Walmart stores have a MoneyGram center to make it simple and fast for you to access your money.

Direct Express And Payday Loans: A Last Resort

As we discussed earlier, you cannot advance future government benefits payments with a Direct Express card. This is because they are prepaid cards rather than credit cards. You can only use them to get access to funds that have been given to you in previous payments.

However, some lenders offer payday loans to those who do not have bank accounts but instead use Direct Express. This is a dangerous option that should only be considered as a very last resort. If you must, you can apply for these small, immediate, and high-cost loans with many vendors both in-person and online. To apply for a loan, you will submit your:

- Name

- Identification card/drivers license

- Income details

Once you are approved, the loan will immediately be put onto your Direct Express card. You can use it at any location that accepts the card.

Be aware that you will need to pay the loan back with interest next time you receive your benefits payment, so use payday loans as a last resort.

Don’t Miss: Are Long Term Disability Insurance Payments Taxable

What Happens If I Lose The Card

You must report a lost or stolen card within two days to limit your liability for losses to $50. If you register the card later than two days, but within 90 days, you could be liable for up to $500 in losses. After 90 days, you could be responsible for all losses.

You should, therefore, report a lost or stolen card as soon as you can so that you’re protected against unauthorized transactions.

As with all financial institutions, it’s a good idea to check your balance frequently to look for transactions you don’t recognize. If you see any unusual activity on your account, you should report it immediately.

How Does The Direct Express Card Work

Each month, your money is automatically deposited to your Direct Express® card account on your payment date. You can go to any bank, credit union, or ATM that shows the Mastercard® logo, even if you do not have a bank account.

- buy from any place that accepts debit card payments

- get cash from any ATM, bank, or credit union that shows the Mastercard® logo

- pay your bills online or over the phone

You May Like: How Much Do You Get If You Go On Disability

How Do Benefits Work And How Can I Qualify

While you work, you pay Social Security taxes. This tax money goes into a trust fund that pays benefits to:

- Those who are currently retired

- To people with disabilities

- To the surviving spouses and children of workers who have died

Each year you work, youll get credits to help you become eligible for benefits when its time for you to retire. Find all the benefits Social Security Administration offers.

There are four main types of benefits that the SSA offers:

-

Learn about earning limits if you plan to work while receiving Social Security benefits

Overview Of The Direct Express Card

| Federal Agency | |

|---|---|

|

|

|

|

|

DC Pension |

|

The Direct Express® card gives you the advantages of direct deposit even if you don’t have a bank account.

- It’s Safe: No need to carry large amounts of cash and no risk of lost or stolen checks.

- It’s Easy: Your money is automatically deposited to your card account on payment day each month. You won’t have to wait for the mail to arrive.

- It’s Convenient: You can make purchases anywhere Debit MasterCard® is accepted and get cash back at retail locations, banks and credit unions, and ATMs throughout the world.

Read Also: How To Apply For Disability In Alabama

Are There Any Fees To Use The Card

Yes, you may need to pay fees for some transactions.

You’re allowed one free ATM cash withdrawal for each benefit payment. If you need further withdrawals, you’ll pay a fee of 85 cents per withdrawal.

For an 85 cent fee, you can withdraw cash over the counter at Walmart.

You can also transfer funds from your Direct Express card into another bank account. You’ll pay a $1.50 fee for each transfer to a U.S. bank account.

Online purchases and bill payments are typically free. You can also buy money orders from the U.S. Post Office to pay bills and pay only the post office fee.

Checking your account balance costs nothing, but if you prefer monthly paper statements, you’ll pay 75 cents each month.

How To Get A Social Security Card

Read Also: Can Social Security Disability Be Taxed

How Can I Apply For A Social Security Debit Card

Provided you receive federal benefits, you can register for the card. Apply at your local Social Security office, visit www.GoDirect.gov, or call the Direct Express card enrollment center at 333-1795.

Once youre accepted, you need not do anything further. Your benefits are conveniently paid directly to your card account each month for access whenever you need them.

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelors degree in science from the University of Leeds and a masters degree in public health from the University of Manchester. Her work has appeared in Netdoctor, Medical News Today, Healthline, Business Insider, Cosmopolitan, Yahoo, Harper’s Bazaar, Men’s Health and more.

When shes not typing madly, Zia enjoys traveling and chasing after her dogs.

How To Access Your Cash With Moneygram

MoneyGram is the worlds 2nd largest money transfer network after Western Union.

You can send money to your MoneyGram account with the Direct Express mobile app. Since you should already have this installed on your mobile device, this is a quick and easy way to access your funds without the physical card present. You can also make this transfer by calling Direct Express customer support at the toll-free number 1 606-3311.

Once you receive the money transfer:

- Ask for the reference number associated with your transfer

- Gather your reference number and personal identification for easy access at the station

- Go to your local MoneyGram venue

- Complete the receiver form

- Hand it to the MoneyGram agent

- Receive your cash

It really is that easy!

Recommended Reading: How Does Short Term Disability Work

Can Anyone Else Benefit From This System

Beyond those who are waiting for their brand-new Direct Express card to arrive, others can benefit from emergency cash:

- People who have lost their Direct Express card have canceled it and are waiting for a new one to arrive in the mail

- Those whose cards have expired and are now waiting for a new one to arrive in the mail

- Those who have had their cards compromised and were forced to cancel it and ask for a new one

How To Stop Social Security Check Payments

The SSA can not pay benefits for the month of a recipients death. That means if the person died in July, the check received in August must be returned. Find out how to return a check to the SSA.

If the payment is by direct deposit, notify the financial institution as soon as possible so it can return any payments received after death. For more about the requirement to return benefits for the month of a beneficiarys death, see the top of page 11 of this SSA publication.

Family members may be eligible for Social Security survivors benefits when a person getting benefits dies. Visit the SSA’s Survivors Benefits page to learn more.

Recommended Reading: Is Down Syndrome An Intellectual Disability

Direct Express Cards Available

Catherine M. Callery | Louise M. Tarantino

Many Social Security and SSI recipients have encountered problems with receiving their monthly benefits in the mail or even by direct deposit into their bank accounts. Problems with lost or stolen paper checks are not uncommon, and of course, exempt Social Security and SSI checks supposedly protected in claimants bank accounts have nonetheless been subject to seizure by creditors.

The U.S. Treasurys optional Direct Express stored value/debit cards allow beneficiaries to receive their monthly payments without the hassles of paper checks or bank accounts. Since its inception in April 2008, the Direct Express card has attracted over 446,000 recipients. It can be used to make purchases and cash withdrawals wherever MasterCard debit cards are accepted, to obtain post office money orders, and to withdraw cash from ATMs.

The Direct Express card eliminates the expense of check cashing services, as well as the risk of stolen checks. It also substantially reduces the danger of exempt Social Security and SSI funds being garnished by creditors. Because the card can only be used to receive Social Security and SSI, exempt funds are never comingled with nonexempt funds. According to the Treasury Department, Comerica, the bank that operates the Direct Express system, will not allow a freeze or garnishment of the money on the cards, except to the extent allowed by federal law .

The Luminate Online Survey was not found.

Getting A Social Security Number For A New Baby

The easiest way to get a Social Security number for your child is at the hospital after they are born when you apply for your childs birth certificate. If you wait to apply for a number at a Social Security office, there may be delays while SSA verifies your childs birth certificate.

Your child will need their own Social Security number so you can:

- Claim your child as a dependent on your income tax return

- Open a bank account in their name

- Get medical coverage for them

- Apply for government services for them

You May Like: Can You Collect Disability And Still Work

Using Direct Express To Pay For Retail Items

You can use a DE card when paying for groceries, gas, services, or any other need the same way you would use an ATM card. You will be given a PIN number or be asked to create a PIN number at sign-up time this is the number you will use to check out with after swiping or inserting the DE card. At the time of this writing, there is no fee for cash back from participating merchants.

However, the DE card does NOT carry overdraft protection and you cannot spend more on the card than your available balance.

How Can I Transfer Money From A Direct Express Card To Another Debit Card

You can’t transfer money from a Direct Express card to another card, but you can transfer money to a personal U.S. bank account. To transfer funds, you’ll need to call the customer service number on the back of your card. You’ll pay a fee of $1.50, which will automatically be deducted from your debit card.

Recommended Reading: How Much Is 60 Percent Military Disability

Direct Express Stimulus Check Payments

The IRS will pays Stimulus payments automatically to the existing Direct Express card accounts of most eligible Veterans, Social Security, SSI, and Railroad Retirement Board recipients. Veterans with Direct Express cards and who filed a 2018 or 2019 tax return should visit the IRS Economic Impact Payments site for more information on how they will receive their payments.

What to Know

- Most eligible Veterans, Social Security, SSI, and Railroad Retirement Board recipients will receive their payments to their Direct Express card by early May.

- Direct Express card fees will not change.

- In addition to the free withdrawal for each benefit payment deposit, cardholders will receive one free ATM withdrawal for their Economic Impact Payment deposit.

- If an Economic Impact Payment is sent to an ac-count that is closed or no longer active, then the payment will be returned and the IRS will reissue the payment.

- All federal benefit payments will continue to be made on time.

- The IRS will mail a letter about the Economic Impact Payment to the recipients last known address within 15 days after the payment is made.

- Only current Direct Express cardholders are eligible to receive Economic Impact Payments on their card.

- Direct Express cardholders can sign up for stimulus payment text or email alerts and view deposit information by logging into their Direct Express account.

Report The Death Of A Social Security Or Medicare Beneficiary

You must report the death of a family member receiving Social Security or Medicare benefits. The Social Security Administration processes death reports for both. Find out how you can report a death and how to cancel benefit payments. In addition to canceling SSA and Medicare benefits, find out what other benefits and accounts you should cancel.

Also Check: Is Va Disability Taxable In California

Update On Hang Seng Bank Branch Service Arrangements

In light of the COVID-19 situation, branch service on Saturdays will resume and service hours of our branches have been adjusted until further notice. For details, please click here.

As a convenient alternative to visiting Hang Seng service outlets, customers are encouraged to use one of the Banks other service channels, such as e-Banking, mobile banking, phone banking or self-service banking to meet their banking needs.

Due to the implementation of enhanced security measures at the universities, access to university campus may be restricted to staff and students only. Customers wishing to visit university branches are encouraged to call our Customer Service Hotline at in advance.

The Bank apologise for any inconvenience caused.

How Does It Work

The federal benefits are paid directly to your card on your monthly payment date. You wont have to wait for a check to arrive in the mail. If you have another bank account, you can transfer the funds to it, but you’ll pay a $1.50 fee for each transfer to a U.S. bank account. If you already have a bank account with a debit card, enrolling in direct deposit may a better option.

Your card comes with a personal identification number that you use to authorize transactions or withdrawals. You can also have your transactions processed as “credit” rather than “debit,” which means you sign for purchases instead, as you would with a credit card. The funds are still deducted from your balance, even when you choose the credit option.

Purchases, withdrawals, and transaction fees are deducted from your balance. Once youve spent all of the funds on the card, youll be unable to use it until you receive your next months benefits.

You can be assured that your money is safe: the funds in your account are FDIC-insured up to the legal limit.

Also Check: Can You Get Disability For Mental Health