The Details Matter Ask Detailed Questions About The Policy

The above features vary from policy to policy, so make sure to ask specific questions thatll help you understand what benefit you will get, when you will get it, and under which circumstances. For a group STD policy, you may not have many options you more or less have to take whats offered. But if youre purchasing an individual LTD policy, it can be a highly personalized contract with riders that tailor the coverage to your specific needs. These questions can help you evaluate the quality of a disability income insurance policy and how well it will support you when you need it most.

How Much Paperwork Is Involved

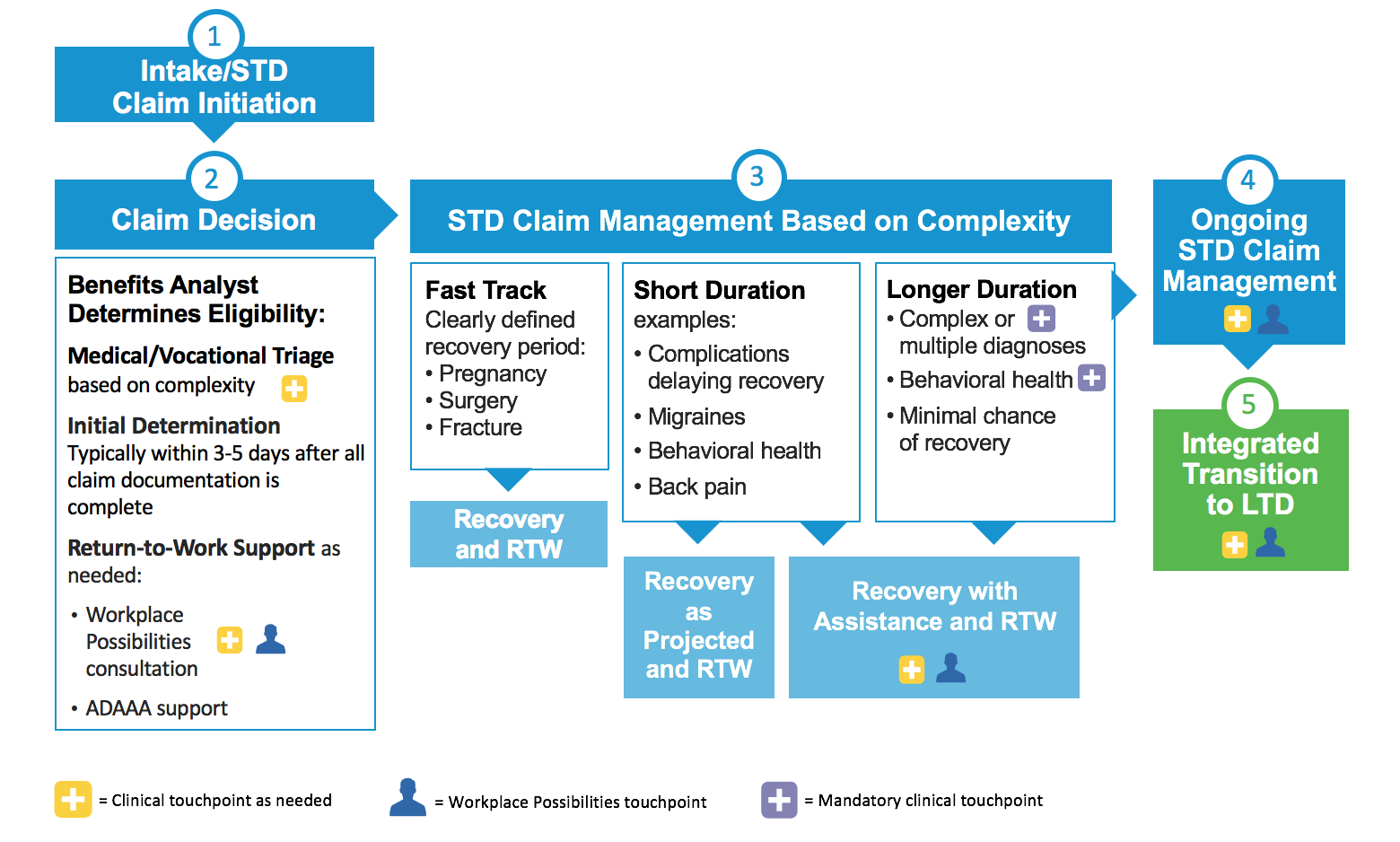

The exact paperwork youll be required to complete is again dependent on your specific plan. But the process typically begins with a relatively straightforward claim form that requires some information from you , your employer , and validation from your doctor that your condition prevents you from working.

Fortunately, if you find yourself confused about any of the documents or applications, you can ask for helpwhether its from your companys own HR department or even people at your doctors office.

I actually found the team at my physicians office to be extremely helpful, says Tiernan, who admits her own leave process was slightly more complicated, as she took advantage of both short-term disability and FMLA for the birth of her child .

They have a whole team dedicated entirely to filling out forms and navigating this process, so I was on the phone with them a lot. They helped me figure out the best forms to fill out, what the dates would be, and any follow-ups that I needed. They even spoke to my HR team directly here at the office.

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Don’t Miss: Non Medical Requirements For Ssi

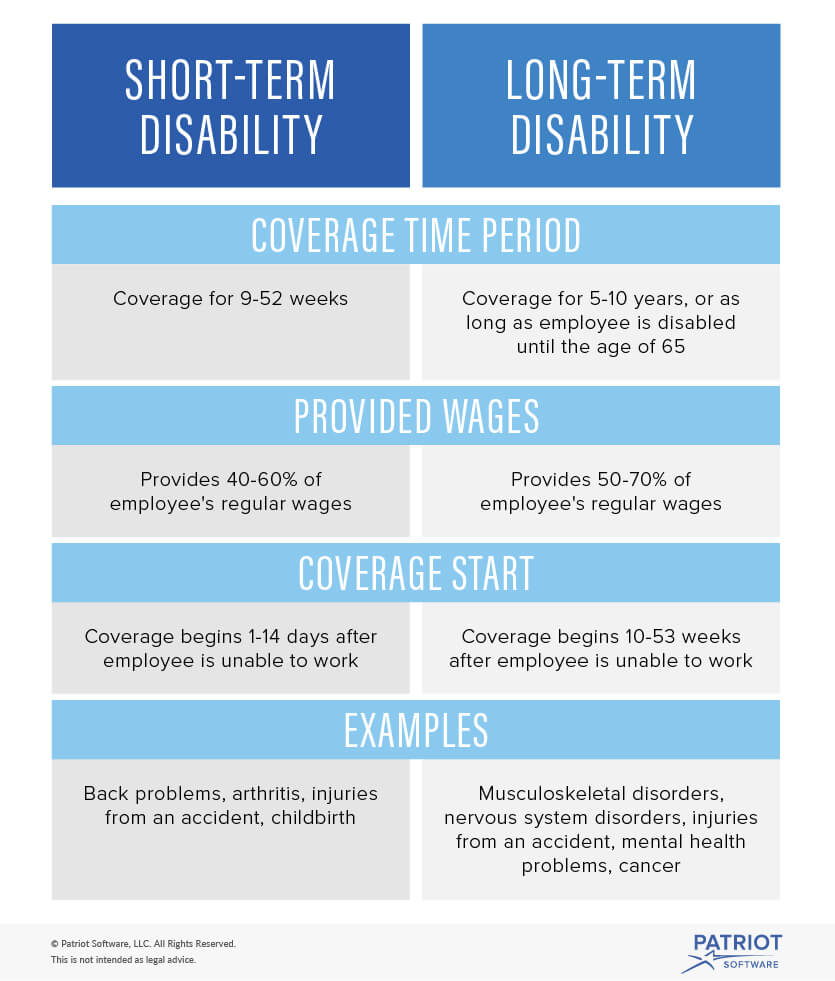

Short Term Disability Vs Long Term Disability

The main differences between short term and long term disability insurance are:

- The injuries and illnesses they cover.

- How long you can receive disability benefits.

- How long you have to wait following a disabling event to receive compensation.

| Coverage Comparison | |

|---|---|

| 1, 7, 14, 30 days | 30, 60, 90, 180, 365 days |

You shouldn’t skip long term disability insurance coverage in lieu of having just a short-term policy. Short term coverage will not be adequate in the event you suffer a serious injury or illness. Without long term coverage, you could find yourself without any kind of income after just a few months.

The best strategy is to buy an individual long term disability insurance policy then supplement it with any short term and/or long term group plans your employer may offer. By combining different types of coverage, you can protect your income against just about any type of injury or illness that would affect your ability to earn an income.

Learn More:Short Term vs. Long Term Disability

Important Information About Disability Benefits

- You must be under a doctors continuous care.

- You must meet the applicable definition of disability for Basic, Voluntary Short-Term or Voluntary Long-Term benefits.

- Theres a 14-day waiting period before you can begin receiving benefits through Basic or Voluntary Short-Term Disability. However, youll need to use up to 22 sick days, if you have them, before benefits begin.

- Mental illness and substance abuse-related benefits are usually limited to a 24-month lifetime maximum through Voluntary Long-Term Disability Insurance.

- If your disability is related to a condition you were diagnosed with, or had treatment for, in the 90 days prior to your initial enrollment in Voluntary Disability Insurance and your disability leave begins within one year after your enrollment, you will not be eligible for Voluntary Long-Term Disability benefits for that condition. You will, however, be eligible for Voluntary Short-Term or Basic Disability benefits, and for Voluntary Long-Term Disability benefits for conditions that were not pre-existing.

- If you are receiving disability benefits through workers compensation, California SDI, Social Security, UCRP, or other sources, they will be coordinated with your Basic and/or Voluntary Disability benefits. In most cases, disability coverage from all sources combined can provide you with a maximum of 60 percent of your eligible earnings.

The Council for Disability Awareness, Disability Statistics, 2012

Read Also: What Is Considered Low Income In South Carolina

How We Chose The Best Short

To determine the best short-term disability income insurance, we looked at all of the companies offering individual policies. While many insurers offer short-term coverage, its typically through the workplace in the form of group policies these policies are often forfeited if you leave that job, and the terms of coverage can vary greatly depending on your employer and what they are willing to provide/cover.

When comparing insurance companies for this list, we looked at the availability of individual policies, coverage limits, and benefit periods offered. We also compared consumer reviews, financial strength ratings, and the ease of obtaining coverage.

Can You Contact Your Employees While Theyre On Short

You have the right to contact employees while theyre on short-term disability as long as you dont ask them to perform any sort of work. For example, if you have a quick question or two about their benefits, or about a work-related procedure, you can reach out.

Unlike some other programs like the Family Medical Leave Act and the Americans with Disabilities Act that provide time off for employees, short-term disability doesnt offer any sort of job protection. Employees on short-term disability also arent entitled to the same job position when they return from it. Its up to your company how youd like to set return-to-work policies.

Also Check: How To Get Higher Va Disability Rating

# How Does Short Term Disability Work

Short-term disability insurance provides financial support for an employee for a period of time if they are absent from work cause of some reason and could not receive a paycheck from their organisation. Short-term disability insurance works by paying some amount of percentage from your salary while youre unable/absence to work.

Social Security Disability Insurance

SSDI is a government program administered by the Social Security Administration. Like the other types of coverage discussed above, SSDI pays benefits in the event a disability prevents you from working.

However, SSDI benefits are the most difficult to qualify for. Qualifications include:

- You must have worked in jobs covered by Social Security.

- You must have worked long enough and recently enough under Social Security.

- You must have a medical condition that meets Social Securityâs definition of disability.

- You must be unable to work for a year or more because of a disability.

- You must have a condition that significantly limits your ability to do basic activities, such as lifting, standing, walking, sitting, and remembering.

You generally will not be considered disabled if you work and earn more than $1,220 per month. If you are not working, Social Security will consider whether you can work. If you can, even if itâs not the type of job you did before your injury or illness, you will not qualify for SSDI benefits. Social Security will base this decision on your medical condition, age, education, past work experience, and transferable skills.

According to the Social Security Administration, only 34 percent of SSDI claimants had their applications approved from 2006 to 2015. Even if you do qualify for SSDI, benefits will likely replace only a small fraction of your income. The average monthly disability benefit in 2019 is $1,234.

Also Check: Bpd And Disability

How Much Does Short Term Disability Insurance Cost

The cost of short term disability insurance is determined by the underwriting process. The underwriting for short term disability insurance may differ slightly from long term disability policies.

Individual long term disability insurance requires full underwriting. Insurers have to assess a personâs risk of filing a claim because benefits may be paid out for a long period. Therefore, insurers will assess your application based on your age, health, gender, the level of risk associated with your job, and any hobbies or interests that could cause disability.

On the other hand, disability insurance carriers may not fully underwrite short term policies. As stated earlier, many short term policies sold on an individual basis are guaranteed issue, which means no underwriting. Others may only require the answering of questions about your health without the medical exam required for long term disability insurance.

Injuries that cause temporary disabilities generally are not related to the insuredâs age, health, job, or other risk factors. They just happen, be it a bad fall that causes a broken bone or a complication of pregnancy. Still, you may be asked about pre-existing health conditions that disqualify you from coverage or that will limit your benefits.

The main factors that affect the cost of short term disability insurance include:

Why You Should Consider Voluntary Disability Insurance

Time away from work for a pregnancy, illness or unexpected injury could mean months without a paycheck. While UCs basic employer-paid disability insurance offers some protection a benefit capped at $800 per month for six months it probably wont be enough to cover your expenses. For a modest monthly premium, UCs Voluntary Disability Insurance replaces much more of your income 60 percent of your eligible pay up to $15,000 per month for increased financial security when you need it most.

Consider the following:

- One in eight workers will be disabled for five years or more before they retire.

- UC does not participate in California SDI .

- The UC Retirement Plan offers disability income only to fully vested members who are disabled for a year or more with a maximum income replacement of 25-40 percent, depending on your retirement tier.

You May Like: How Much Do You Get Paid On Disability In California

What Doesnt Short Term Disability Insurance Cover

Your short term disability insurance policy will likely include coverage exclusions. These will be listed in your policy contract.

Exclusions mitigate a carrierâs risk of paying a claim resulting from high-risk conditions or activities, and typically include:

- Intentionally self-inflicted injuries

- Diabetes

- Neurological disorders

Furthermore, donât count on short term disability policies to cover time off to care for a sick family member or adopt a child.

If you have short term disability insurance through your employer, many of these plans require that youve worked a certain amount of time before coverage begins. Many employers also require that you exhaust paid sick leave or use paid time off before you are eligible for short term disability benefits.

You May Like: Does Dental Insurance Cover Veneers

Does Maternity Leave Count As Short

Youve probably heard of circumstances where people use their short-term disability for pregnancy and maternity leave. Doing so is fairly common, but whether or not youre able to do so yourself is also dependent on your plan.

We actually see a lot of short-term disability policies that specifically address maternity leave, explains Bartolic. These plans also will explain how much time off is offered for maternity leave, which can vary based on things like whether the mother had a vaginal birth or a c-section.

Some employers exclude maternity leave from their short-term disability plan and have an entirely separate program to address paid leave for childbirth.

Don’t Miss: How To Increase Va Disability Percentage

What Is The Difference Between Individual Disability Insurance And Group Disability Insurance

Individual Disability Insurance is purchased by individuals privately in order to provide a safeguard against illness or injury which results in temporary and/or complete or total disability that prevents them from being able to work. You may choose to purchase additional disability insurance even if you already have some coverage from your employer. Insurance companies will usually offer a larger variety of features for individual disability insurance policies than they will for employers group disability insurance policies.

Group Disability Insurance is purchased by businesses and provides disability coverage to employees who are temporarily and/or completely or totally disabled and therefore unable to work as a result of a medical condition. If in a group plan, payments for the premiums may be paid by you through your paychecks or your employer may pay all or part of the premiums itself. Ask your employer if you are covered under such a policy.

Understand Your Short Term Disability Coverage

Before you apply for Short Term Disability, its important that you understand your insurance coverage. If you are offered group disability coverage through your employer, contact your Plan The administrator or Human Resource staff to help understand the extent of the coverage, or consult your benefits booklet. In case your employer does provide this coverage, you will be required to make your claim through the group plan.

Although your employer does not offer short term disability coverage as part of their group plan, you may be eligible for Employment Insurance benefits. For more information on whether you qualify for EI, check out the government of Canadas website here.

Other elements of your coverage that are important to understanding are your coverage amounts, which relate to how much benefit you will receive and how often. You will also want to know when you will start receiving the benefit if the benefit is taxable, and if your plan covers the third party claims management service like the Disability Management Institute as do most plans at GroupHEALTH.

Don’t Miss: Adhd Mental Retardation

Pros And Cons Of Long

The pros of buying long-term disability coverage generally outweigh the cons, especially if youâre able to find an affordable policy.

Pros:

-

Benefits are tax-free if you pay for your own policy

-

You can spend the benefit however you want

-

You donât have to pay back the benefits you get

Cons:

Read Also: How To Collect Disability In Nj

Know Your Critical Dates

Some of your application paperwork must be submitted within a certain amount of time from the start of your leave from work often within the first 30 days. Late submissions may impact your eligibility for benefits. It may take time for your insurer to review, adjudicate and process your claim: it is common for the adjudication process to take at least 10 business days.

Recommended Reading: Blind In One Eye Can I Get Disability

Get Legal Advice And Help

Filing a claim for LTD can be a difficult, confusing and lengthy process. Each policy is different. A personal injury or disability insurance lawyer can help you understand your policy, notify you of any deadlines, guide you through the claim process, and deal with the insurance company. This will help ensure that you will get the benefits you deserve in a timely manner.

Even when an individual has a legitimate cause for claiming their long-term disability benefits, often insurance companies will initially deny the claim, or offer an amount much lower than asked for.

If you or someone you care about suffers from a long-term disability and has disability insurance, contact our preferred experts. They can help you get the LTD benefits you are entitled to, even if your claim was denied. They offer a free consultation and do not charge up-front fees:

Also Check: How To Increase Your Va Disability Rating

Should I Purchase Short

Although illnesses and injuries can’t be predicted, they’re likely to affect your workplace at some point in the future. For comprehensive protection, employers may consider offering a combination of both short-term and long-term disability insurance to employees. These policies are an important complement to any group health insurance plan and help to minimize the impact of debilitating illnesses and injuries on both your employees and your business.

Read Also: How To Track My Disability Back Pay

How Does Employment Insurance Work With Short Term Disability

Employment Insurance is a federal benefit that operates very similarly to STD, providing income replacement in the event an accident, illness, or injury prevents you from working. If you become unable to work and have STD through an employer, your STD benefit will take priority over any EI benefits.

Since the coverages work very similarly, were often asked something along the lines of, Why should I have STD if EI already covers me?

While its true that EI offers similar coverage, there are several advantages to a STD plan over EI benefits. EI is not usually as comprehensive an employer-sponsored STD plan, often having longer waiting periods and lower weekly payments. Furthermore, EIs income replacement is taxable to the employee, whereas STD benefits, depending on plan design, are not. Both STD and LTD benefits can be set up as taxable to the employee or non-taxable to the employee .

What Doesnt Long Term Disability Insurance Cover

Long term disability insurance covers a lot, but it canât cover everything. There are almost always coverage exclusions and limitations.

To avoid any confusion or surprises, exclusions and limitations will be listed in your policy contract. The purpose of coverage exclusions is to mitigate the insurance carriers risk of paying a claim resulting from high-risk conditions or activities.

Some common examples of exclusions that apply to all applicants include:

- Self-inflicted acts

- Civil disobedience or rebellion

- Operating a motor vehicle while intoxicated

Depending on your medical underwriting and lifestyle choices, you may also receive individual exclusions. For example, if you have had a herniated disc, your policy may exclude claims resulting from spinal injuries. Many policies also limit benefits if a mental illness or nervous disorder limits your ability to work.

Since they are sometimes confused, its important to highlight the difference between long term disability and long term care insurance. A long term care policy will cover the costs of nursing homes, assisted living facilities, or in-home care if you become unable to care for yourself. However, it will not replace lost income like a long term disability policy.

Also Check: Applying For Disability In Texas