How Other Benefits Affect Your Sdi Benefit

Sick pay or PTO. Paid sick time, PTO, or holiday pay that you receive while receiving SDI will be subtracted from your SDI benefit amount, as will wages for part-time work . You can ask the EDD to “integrate” the SDI benefit with your sick pay or PTO, however. If your employer agrees, your employer can pay you just enough sick time or PTO so that, when combined with SDI, you will be receiving the same amount as your normal salary or wages. On your application form, you write “Integrated Benefits” for the type of pay you are receiving from your employer.

In addition, you may receive sick time or PTO for the first seven days of your disability, since SDI will only start paying you on the eighth day.

Paid vacation. Receiving paid vacation benefits will not affect your SDI payment.

Social Security disability. If you apply for and are approved for Social Security disability benefits, the state may subtract your disability benefits from your SDI payment.

How Does Short Term Disability Work

There are 2 main ways that short term disability works. Self-administered short term disability means that youll fund the disability program yourself. While that means making a lot of decisions about how you want to fund and structure the benefit, it does offer maximum control over its parameters.

The other option is through insurance. You can choose to work with an insurance provider that offers short term disability benefits to your employees.

If you elect to do neither, your employees arent out of luck. People have the ability to purchase short term disability insurance for themselves. But as with all insurance that isnt subsidized by an employer, the costs will be high roughly 1 to 3% of a persons yearly earnings depending on the structure of the coverage. A shorter elimination period , for example, means paying more money.

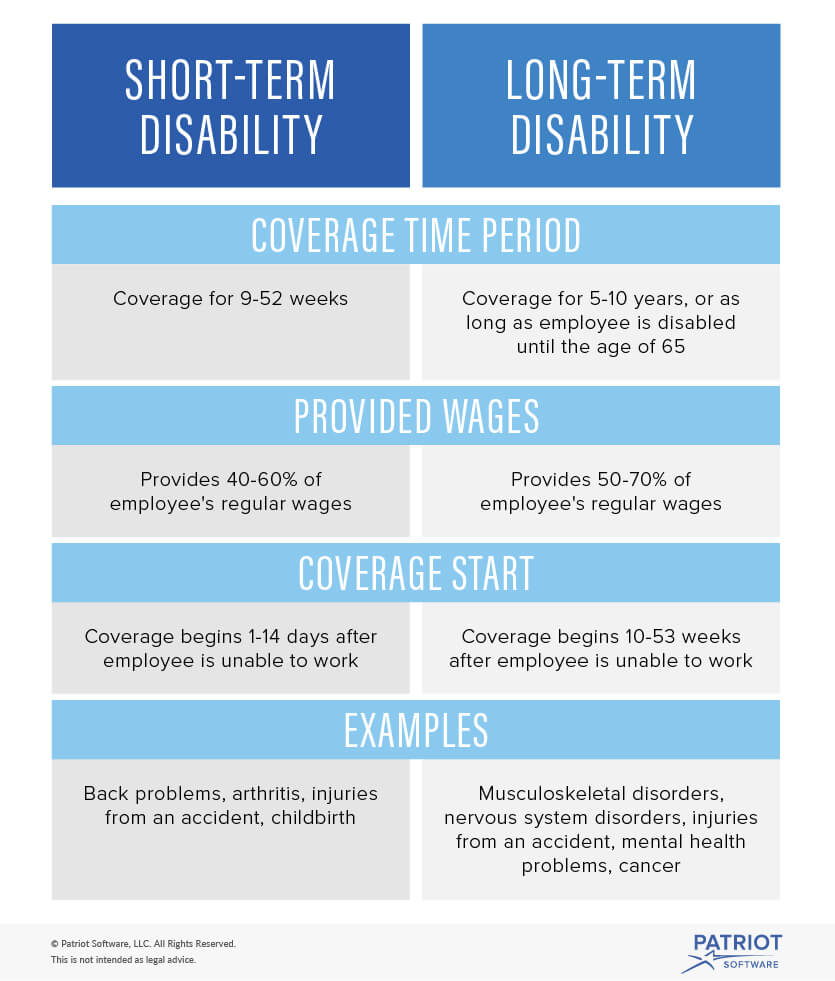

Long Term Vs Short Term Disability Insurance

Created by FindLaw’s team of legal writers and editors

Disability insurance is an insurance policy that covers some of an individual’s lost income while that individual is unable to work due to an illness or injury. Some disability insurance policies cover workers for a short period of a matter of months, while others provide stable benefits for decades. Deciding whether to get short term, long term, or both types of disability insurance depends on the individual worker’s needs, expectations, and budget.

Also Check: How To Get Disability For Multiple Sclerosis

Amount Of Sdi Payments

The amount of your bi-weekly payment is tied to how much you earned during your base period. You will be paid 60-70% the amount of the average wages that you were paid by your employer during the calendar quarter of the base period that you made the most money. If you worked two jobs during your base period, your average wages will include wages from both jobs.

However, the maximum weekly amount is $1,357 . SDI payments are not taxable .

The EDD website includes a chart of weekly SDI benefit amounts based on the amount of money you made in the highest quarter of your base period.

After Being Unable To Work At My Own Job For Two Years Can My Insurance Company Stop Paying Me My Benefits

For most policies you are entitled to claim long term disability benefits for the first 2 years of being unable to perform the essential duties of your own job. This is called the Own Occupation Test. After this 2 year time period your eligibility for long term disability benefits will likely change. It will then be based on whether you are unable to perform any occupation for which you are reasonably qualified, or could become qualified for, by taking into consideration education, training or experience. This is called the Any Occupation Test.

Also Check: How Much Is Disability In Ca

When Do Disability Benefits Start

Before asking how long benefits last, you need to know how long it is before they even begin â known as the elimination period, or waiting period.

The elimination period for short-term disability insurance is usually under 14 days. Long-term policy elimination periods range from 30 days to two years, but the most common is 90 days. The longer the elimination period â the longer you can go without accessing your policy benefits â the cheaper the policy.

As mentioned previously, this is a good example of how short-term disability insurance can complement long-term insurance. Between short-term insurance and liquid savings, you can increase the elimination period of your long-term policy and lower the cost significantly.

Get Legal Advice And Help

Filing a claim for LTD can be a difficult, confusing and lengthy process. Each policy is different. A personal injury or disability insurance lawyer can help you understand your policy, notify you of any deadlines, guide you through the claim process, and deal with the insurance company. This will help ensure that you will get the benefits you deserve in a timely manner.

Even when an individual has a legitimate cause for claiming their long-term disability benefits, often insurance companies will initially deny the claim, or offer an amount much lower than asked for.

If you or someone you care about suffers from;a;long-term;disability and has disability insurance, contact our preferred experts. They can help you get the LTD benefits you are entitled to, even if your claim was denied. They offer a;free;consultation and;do not;charge up-front fees:

Recommended Reading: California Disability Amount

Whats It Like To Return To Work After Short

As the above answer illustrates, depending on your disability, different logistical elements obviously need to be sorted out upon your return.

But thats not the only factor at play heretheres also an emotional and relational element involved when you return to the office after an extended amount of time off.

Most of it was just emotional and mental fatigue after having spent four months not really on a computer every day or using my brain in that kind of way, says Tiernan.

There was the expectation that I was going to be able to jump back in right away, she adds. Looking back, I appreciate that now because I dont think I wouldve been able to transition as well as I had if it had been slow.

In addition, companies arent stagnant and there are likely some larger changes that will happen while youre out on your leaveincluding employees leaving and new team members being added. There were shifts that occurred during my time gone, so I needed to readjust to the changes that had happened, Tiernan adds.

I Think That I Need To Sue For Disability Benefits But I Have No Income What If I Cannot Afford A Lawyer

Most disability insurance lawyers, including Roger Foisy, work on a contingency fee basis. This means that the lawyer only collects their legal fee if they are successful in your claim. In addition, Roger R. Foisy Professional Corporation offers an initial free consultation to potential clients. For a helpful explanation on how fees are determined please see my video blog How Ontario Injury Lawyer Fees are Determined.

Recommended Reading: Can You Get Disability For Copd

Answers To Frequently Asked Questions About Short

What are short-term disability benefits?

Short-term disability is a weekly income benefit. Insurance companies or employers pay eligible workers who cant work because of disability or illness.

Who is eligible for short-term disability benefits?

To be eligible for short-term disability benefits, there are 2 main criteria. These are more detailed in the insurance policy or program. Firstly, you must be covered by a plan. For example, employees are members of a group insurance policy. If youre covered, you must also meet the disability requirements. Usually, this means that you suffer from an illness or disability that prevents you from doing your job.

How long does short-term disability last?

Short-term disability benefits are paid for a specific period of time. This is called the benefit period. The maximum benefit period is 17 weeks for most plans but can go as high as 52 weeks.

How much does short-term disability pay?

The payment is usually based on what you earned before you had to leave work. You will get anywhere from 55% to 100% of what you used to make. You get payments weekly until the benefit period ends.

Can I be laid off or terminated while on short-term disability?Can I get short-term disability and EI sickness benefits?

You cant receive both benefits for the same period. If you do, then you will have to refund EI sickness. You can get them back-to-back, however.

Should I go on workers compensation or short-term disability?

How Much Will You Get Paid When You Take Short

When you take advantage of your short-term disability benefit, your time off is paidbut that doesnt necessarily mean youll be getting your full paycheck.

The amount youll earn is dependent on your specific plan. Some plans offer full salary replacement, but most dont. Instead, they offer a percentage of compensation with a dollar amount cap.

There are also programs that award you different amounts based on your longevity with the company, says McDonald. If you are there for 10 years and have a 26-week disability period, you might get three months at 100% and then three months at 50%.

If you live in one of the five states where short-term disability benefits are mandated, then the amount youll be compensated will be regulated as well.

Don’t Miss: Do You Accrue Pto While On Short Term Disability

How Long Does Short

While benefit periods may vary across different providers, most short-term disability policies provide benefits for three to six months. Some policies, especially those connected with a long-term disability policy, may provide short-term coverage for a full year. If an employee needs additional coverage beyond the initial short-term disability period, a long-term disability policy may be needed to extend the benefits.

If The Insurance Company Agrees That I Am Still Entitled To Benefits What Are The Different Ways That My Settlement Can Be Paid To Me

If your disability benefits claim goes to court and is successful then you will be awarded some or all of the outstanding disability benefits that you should have, plus interest and costs, all of which is paid by the insurance company. The judge hearing your case may also order that the insurance company continue to pay for your benefits into the future as long as you are entitled to receive such benefits under your policy.

However, many cases settle on the basis of an agreed amount of money that represents a full and final payment to you for past and future benefits. This agreed amount is determined between you and the insurance company.

If your LTD has been denied or terminated, contact us for a free consultation. Call us at or fill out our form on this page.

Recommended Reading: Generalized Anxiety Disorder Va Rating

Does Short Term Disability Cover Pregnancy And Maternity Leave

Maternity leave is one of the most common uses of short term disability insurance. Many policies pay benefits up to six weeks after a normal delivery. For a C-section, women may receive up to eight weeks of benefits.

Keep in mind that benefits are subject to the policyâs waiting period. If the policy has a seven-day waiting period, benefits start seven days following delivery.

Itâs also very important to understand that pregnancy is considered a pre-existing condition. That means if you were pregnant prior to signing up for coverage and your policy limits benefits for pre-existing conditions, you would receive limited or no benefits for pregnancy-related time off.

If there are complications resulting from the pregnancy or delivery, you may qualify for additional benefits, either before or after delivery. This will require certification from your doctor.

Need Help Filing A Disability Claim Get Legal Help Today

With so many different types of disability insurance, options, and various involved parties, the process can get overwhelming for anyone without a law degree. Have additional questions? Learn more on our disability law legal answers page or contact a disability lawyer to learn more about private disability insurance, and an ERISA lawyer for questions regarding employer-sponsored disability benefits.

Thank you for subscribing!

Don’t Miss: Gerald Welt Attorney Las Vegas

Does Maternity Leave Count As Short

Youve probably heard of circumstances where people use their short-term disability for pregnancy and maternity leave. Doing so is fairly common, but whether or not youre able to do so yourself is also dependent on your plan.

We actually see a lot of short-term disability policies that specifically address maternity leave, explains Bartolic. These plans also will explain how much time off is offered for maternity leave, which can vary based on things like whether the mother had a vaginal birth or a c-section.

Some employers exclude maternity leave from their short-term disability plan and have an entirely separate program to address paid leave for childbirth.

Benefits Of A Shorter Elimination Period

The main reason to choose a shorter elimination period is if you have a lot of expenses that you know wont be able to be met without continuing to get some income. The catch-22 here, however, is that the shorter the elimination period, the higher the premiums, so if money is truly tight, you may not be able to afford that peace of mind.

You May Like: How Much Does Disability Pay For Bipolar

Read Also: Is Disability Insurance Tax Deductible For Corporations

How Much Will I Receive From Long Term Disability Insurance Benefits

For employer-sponsored group long term disability insurance, benefits can cover 50% to 80% of your pre-disability salary, with a typical policy covering 66.66%. However for many policies, there may be monthly maximums which put a limit on the amount you can receive.

For individual, private disability policies, benefits are pre-determined by the disability policy so that an injured or sick person already understands what their monthly disability benefit will amount to in the event they are unable to work.

Pros And Cons Of Long

The pros of buying long-term disability coverage generally outweigh the cons, especially if youâre able to find an affordable policy.

Pros:

-

Benefits are tax-free if you pay for your own policy

-

You can spend the benefit however you want

-

You donât have to pay back the benefits you get

Cons:

-

Coverage costs more the older you get or the more dangerous your occupation is

-

Policies can come with exclusions that donât cover pre-existing conditions

-

You may pay for coverage you donât need if you never experience a disability

Read Also: How To Collect Disability In Nj

Is Your Job Protected While You Take Short

Unlike a leave of absence you might take under the Family and Medical Leave Act , short-term disability doesnt offer any direct job protection. Many people are surprised to hear that you can legally be fired from your job while on leave, and you also arent entitled to the exact same position when you return.

However, the Americans With Disabilities Act protects people who meet the ADAs definition of disability, and makes it far more challenging for companies who are covered by ADA to fire an employee due to their disability.

Before terminating an employee, the company must first determine whether or not there are any accommodations they could make that would allow the employee to adequately do their job.

The company must work with the employee to try several variations of accommodations in an effort to find something that works. If theres no reasonable way to enable that person to fulfill the essential responsibilities of their position, only then can the employer explore termination of the employee.

What If Youre Still Not Ready To Go Back To Work

If youre on short-term disability, your benefits will end when your predetermined time period is over or when you return to workwhichever comes first. But what if youve already maxed out your short-term disability benefits and you still cant head back into the office?

Lets return to our example of missing out on work for major back surgery. Your doctor determined that youd need six months to fully recover, and your short-term disability plan approved you for that amount of time.

However, you had some pretty significant complications with your surgery and your recovery. As the end of those six months draw near, its evident that you arent physically capable of sitting at a desk for eight hours each daythis is a problem that will plague you for a lot longer, perhaps even permanently. Now what? Are you just out of luck?

If you have long-term disability benefits, it should be straightforward enough to transition into those benefits if you meet the new definition of disability for your long-term plan. The definition for disability under a long-term plan is typically subtly different than the definition for short-term disability.

Some insurers require new paperwork from the claimant and new medical records before they will begin paying a long-term disability benefit, says McDonald.

You May Like: Can You Get Disability For Sciatica Pain

Know Your Critical Dates

Some of your application paperwork must be submitted within a certain amount of time from the start of your leave from work often within the first 30 days. Late submissions may impact your eligibility for benefits. It may take time for your insurer to review, adjudicate and process your claim: it is common for the adjudication process to take at least 10 business days.

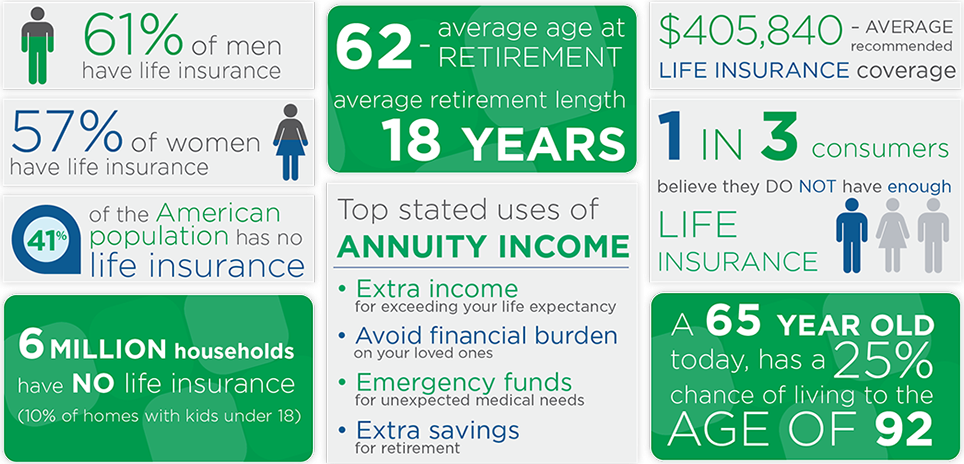

The Importance Of Short And Long

Its important that employees have a plan in place. One in four people in their 20s will become disabled before they turn 67, according to the Social Security Administration.

Providing short-term and long-term disability insurance at your business is a great benefit. Dealing with an illness or injury for an extended period of time is stressful on its own before factoring in the loss of wages.

Keep track of employee benefits and deductions with Patriots online payroll software. We make it easy to run payroll with our simple 3-step process. Try it for free today!

This is not intended as legal advice; for more information, please

Also Check: Utc Disability Resource Center