What Should You Know When Buying Short Term Disability Insurance

Before you start shopping for short term disability insurance, check with your employer to see if a policy is available at work, and look into the disability benefits offered in your state, so you know whether to factor something like temporary disability insurance into your overall plan. When comparing policies, you should know how much income youll need to replace if youre unable to work and how long youll need to receive benefits. If you have a long term disability policy in place, youll want to make sure that youre short term benefits dont run out before your long term benefits begins, so plan to have a short term policy that will cover you during the waiting period, or elimination period, in your long term policy.

You May Qualify For Legal Assistance

Figuring out which temporary or short-term disability benefits you may qualify for can be confusing, depending on your specific circumstances. Having an attorney file your claim makes you 2x more likely to win benefits the first time you apply. Plus, an attorney can get you the maximum benefits you may qualify for, regardless of your claim type.

Who Can Apply For New Jerseys Temporary Disability Benefits

Employers who pay workers at least $1,000 per year are covered by the New Jersey Temporary Disability Benefits Law . If youre unable to work due to an illness or injury that isnt work-related, you can file a TBDL claim. Be sure to file your claim within 30 days after your first missed day of work, though. Qualified applicants can receive up to 26 weeks of temporary disability benefits with a maximum payment of $881/week in 2020. For more details about the TBDL, visit myleavebenefits.nj.gov.

You May Like: 90 Percent Va Disability

What Medical Conditions Qualify For Cpp Disability

Any medical condition can qualify for CPP disability if it prevents you from doing gainful employment. You must also prove that your disability is permanent.

If you suffer from a terminal illness, then CPP disability will fast-track your application.

Following is the offical requirement for CPP disability benefits. Your medical condition must cause a level of disaiblity to meet the following requirement:

Section 42. When a person is deemed disabled For the purposes of this Act,

a person shall be considered to be disabled only if he is determined in the prescribed manner to have a severe and prlonged mental or physical disability, and for the purposes of this paragraph,

a disability is severe only if by reason thereof the person in respect of whom the determination is made is incapable of regularly pursing any substantially gainful employment, and

a disability is prolonged only if it is determined in the prescribed manner that the disability is likely to be long continued and of indefinite duration or is likely to result in death

In common terms, you can only qualify for CPP disability if your medical condition causes permanent disablity that prevents you from regularly doing any employment.

Illnesses Eligible For Baltimore Short Term Disability

Short-term disability benefits are also available to people suffering from serious illnesses. Unfortunately, these claims can be harder to get approved it can be difficult to demonstrate that your illness is going to result in disability. Many illnesses start off minor but can deteriorate over time. However, you should be aware that many policies exclude pre-existing conditions. As a result, you may not be able to claim short-term disability if you become ill due to a heart condition that you have had for several years prior to obtaining coverage. It is best to consult with a Baltimore short-term disability lawyer about your medical history to determine if you may be eligible to file a claim.

Don’t Miss: Change Va Direct Deposit

What Doesn’t Short Term Disability Insurance Cover

Your short term disability insurance policy will likely include coverage exclusions. These will be listed in your policy contract.

Exclusions mitigate a carrierâs risk of paying a claim resulting from high-risk conditions or activities, and typically include:

- Intentionally self-inflicted injuries

- Diabetes

- Neurological disorders

Furthermore, donât count on short term disability policies to cover time off to care for a sick family member or adopt a child.

If you have short term disability insurance through your employer, many of these plans require that you’ve worked a certain amount of time before coverage begins. Many employers also require that you exhaust paid sick leave or use paid time off before you are eligible for short term disability benefits.

Whats Not Covered By Short

- Disabilities that happen in the workplace. About 10% of disabilities happen within the workplace, and are covered separately by workers compensation.

- Long-term disability. Long-term disability insurance general covers any disabilities that last for 6+ months.

- Severe health conditions. Social Security Disability Insurance is available to US residents with severe health conditions who either havent worked or accrued enough credits to be eligible for employer-sponsored disability insurance.

Recommended Reading: How To File For Disability In Missouri

Does Maternity Leave Count As Short

Youve probably heard of circumstances where people use their short-term disability for pregnancy and maternity leave. Doing so is fairly common, but whether or not youre able to do so yourself is also dependent on your plan.

We actually see a lot of short-term disability policies that specifically address maternity leave, explains Bartolic. These plans also will explain how much time off is offered for maternity leave, which can vary based on things like whether the mother had a vaginal birth or a c-section.

Some employers exclude maternity leave from their short-term disability plan and have an entirely separate program to address paid leave for childbirth.

Appealing A Denial Of Short

A denial is when an insurance company refuses to pay a claim. You can get denied if you dont qualify in the first place. However, sometimes claims are denied when they shouldnt be. In this case, the decision can be changed.

There are usually two levels of appeal. Firstly, there are internal appeals. If you dont get approved, then you might move onto a hearing or lawsuit next.

But first, lets review some key things you should know about before you appeal.

The denial letter

The denial letter is an important document. It will include the information you need to make your appeal. By law, the insurance company must give you a denial in writing. So, they will either mail or email the denial letter to you.

Firstly, it tells you that you have the right to appeal. Then, it will often say why you got denied. These reasons are crucial because they can help you build your case. For example, a smart way to appeal is to list each reason. Then, challenge the reasons with new information. You can also share these with your doctor. They may write a new medical letter by talking about each reason.

To read more about reasons for denial, check out our article:

Finally, the letter will give you a deadline. The deadline may be a date or a number of days. For example, you might have 60 days. Or, you might have to appeal by September 30, 2020.

Deadlines for appeal

On the other hand, there may be hard deadlines. If you miss a hard deadline, then you may lose your right to more appeals.

You May Like: Af Retirement Pay Calculator

Who Is Eligible For New York Short

In order to be eligible for short-term disability benefits, you must have become injured or ill while not at work but must be employed, or recently employed, at the time of illness or injury. Additionally, pregnancy is covered under short-term disability.

The employees who are covered by disability include:

- An individual who is working or has recently worked at least four consecutive weeks at a job that is considered to be owned by a “covered employer.”

- Individuals who change from one covered employer to another covered employer. As long as your employment was continuous, coverage for short-term disability starts on your first day of work.

- Domestic workers who work 40 hours or more for one employer. An example of this would be a nanny or personal assistant.

- Individuals who are not employed by a covered employer but elect for voluntary coverage.

How Do I Get Emergency Disability

First, only SSI applicants who are experiencing extreme hardship qualify for emergency payments. If you qualify only for Social Security disability insurance benefits, you cant receive emergency payments. But it sounds like your income is low and youve exhausted your assets, so you will like qualify for SSI.

Don’t Miss: What Does Non Medical Disability Mean

Disability Benefits For Veterans

You may be eligible for disability benefits if you’re on disability from your service in the Canadian Armed Forces or Merchant Navy.

You may get social assistance payments from:

- your province or territory

- your First Nation

These payments will depend on your household income, savings and investments.

You may also be eligible for health-related benefits from your province or territory. These benefits may include benefits that help cover the cost of:

- medications

- medical aids or devices

How Long Does Short

While benefit periods may vary across different providers, most short-term disability policies provide benefits for three to six months. Some policies, especially those connected with a long-term disability policy, may provide short-term coverage for a full year. If an employee needs additional coverage beyond the initial short-term disability period, a long-term disability policy may be needed to extend the benefits.

Recommended Reading: What Are Non Medical Requirements For Disability

How Much Does Short Term Disability Insurance Cost

The cost of short term disability insurance is determined by the underwriting process. The underwriting for short term disability insurance may differ slightly from long term disability policies.

Individual long term disability insurance requires full underwriting. Insurers have to assess a personâs risk of filing a claim because benefits may be paid out for a long period. Therefore, insurers will assess your application based on your age, health, gender, the level of risk associated with your job, and any hobbies or interests that could cause disability.

On the other hand, disability insurance carriers may not fully underwrite short term policies. As stated earlier, many short term policies sold on an individual basis are guaranteed issue, which means no underwriting. Others may only require the answering of questions about your health without the medical exam required for long term disability insurance.

Injuries that cause temporary disabilities generally are not related to the insuredâs age, health, job, or other risk factors. They just happen, be it a bad fall that causes a broken bone or a complication of pregnancy. Still, you may be asked about pre-existing health conditions that disqualify you from coverage or that will limit your benefits.

The main factors that affect the cost of short term disability insurance include:

Is Mental Health Covered With Short

What if its not something physical that takes you away from the demands of your job? What if youre struggling with depression or some other mental health issue that makes it nearly impossible to fulfill your work responsibilities?

Mental health can be covered by many short-term disability plans . However, youre going to need to have proof that this is an issue youve been struggling with for some time.

You should be talking with a psychiatrist before your leave, says McDonald. There should be a really solid foundation of what the problems are.

Don’t Miss: What Percentage Of Va Disability Claims Are Approved

Whats The Difference Between Short Term Disability And Temporary Disability Insurance

Temporary disability insurance is offered to workers through a government program in some states . This insurance is meant to compliment workers compensation benefits by covering disabling illnesses or injuries that dont happen at work or result from working conditions. Unlike short term disability insurance, it is only available in a handful of states. If you live in a state that offers temporary disability insurance, look into how much the benefit would pay to you compared to your expenses. If you determine that you would need more coverage, you may consider applying for a short term disability insurance to help make up for the gap in pay. If you dont live in a state that offers temporary disability insurance, it will be that much more important to ensured youre protected by a disability policy through your employer or purchased individually.

How Long Does Long

Once long-term disability benefits have been approved, an employee can continue to receive benefits for the length of the policy term or until they return to work. Most long-term disability plans provide coverage for 36 months, although some plans can provide coverage for up to 10 years or even for the life of the policyholder.

You May Like: How To Apply For Disability In The State Of Georgia

How Much Will You Get Paid When You Take Short

When you take advantage of your short-term disability benefit, your time off is paidbut that doesnt necessarily mean youll be getting your full paycheck.

The amount youll earn is dependent on your specific plan. Some plans offer full salary replacement, but most dont. Instead, they offer a percentage of compensation with a dollar amount cap.

There are also programs that award you different amounts based on your longevity with the company, says McDonald. If you are there for 10 years and have a 26-week disability period, you might get three months at 100% and then three months at 50%.

If you live in one of the five states where short-term disability benefits are mandated, then the amount youll be compensated will be regulated as well.

How Do I Get Individual Disability Insurance

If youre self-employed, your employer doesnt offer disability insurance, or you want to supplement the policy your employers does offer, you can apply for an individual disability policy. Individual disability insurance elimination and benefit periods may differ from group disability insurance plans, but a financial representative can help you choose the right coverage for your situation. If youd like some help understanding what type of coverage makes sense for you and applying for a policy, get in touch with a financial representative who can help you make a decision.

If youre not ready to speak to a financial representative, but youre curious how individual disability insurance would fit into your financial plan, get a free quote now.

Individual disability income products underwritten and issued by Berkshire Life Insurance Company of America , Pittsfield, MA. BLICOA is a wholly owned stock subsidiary of The Guardian Life Insurance Company of America , New York, NY. Product provisions and availability may vary by state.

Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof.

2020-103389 20220330

Also Check: Nolo Social Security Disability

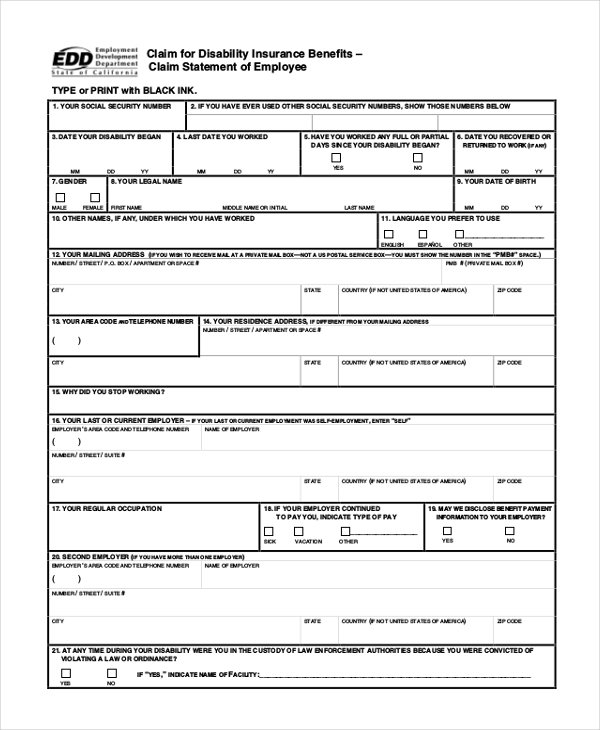

How Do I Apply For Short Term Disability In Pa

Social Security Disability has many benefits that make going through the application process worth the hassle in fact, you have no shortage of options when you are ready to apply. You can either hire an experienced lawyer, or start the application process either online at SSA.gov, or in person.

You will be asked questions about your ailment, what you have done to mitigate further damage to your body, where you work and the activities you perform. Most initial applications are denied by default unless you are paralyzed, blind or over 65.

Denied applications will go through an appeals process that could take one or several years. If accepted, you will receive back pay based on when you applied, and when you were granted benefits. With an attorney working on your case, you are likelier to get approved much quicker than if you re-applied without one.

What Medical Conditions Qualify For The Disability Tax Credit

The disability tax credit is different from other disability benefits plans. The above disability plans focus on how your medical condition affects your ability to work. The is not focused on your ability to work. Rather, it focuses on impairment with your daily activities.

Eligibility Criteria for the Disability Tax Credit

- be blind

- be in at least one basic activity of daily living

- be significantly restricted in two or more basic activities of daily living

- need life sustaining therapy

You will automatically qualify for the disability tax credit if your medical condition causes blindness or you to need life sustaining therapy.

To qualify as blind your visual acuity in both eyes must be 20/200 or less or your field of vision in both eyes is 20 degrees or less.

To qualify under the life sustaining therapy requirement, the therapy must be needed to support a vital function, and you must need it at least 3 times per week for an average of 14 hours per week.

The basic activities of daily living include the following:

- Speaking

- Dressing

- Mental functions necessary for everyday life

To qualify for the disability tax credit you must show that you are markedly restricted in one of these areas. A marked restriction means that you are unable to do the BADL or take an inordinate amount of time to do it. This restriction must be present 90% of the time.

Learn the secrets for winning disability benefits, even after a denial

Don’t Miss: Military Retirement Pay Calculator

Understanding The Difference Between Short

Does your employers benefits package include short-term disability insurance coverage? If so, heres what you need to know about getting short-term disability benefits through your employer:

Keep in mind that temporary and short-term disability benefits dont last very long after you do qualify for assistance. Depending on where you live, workers compensation typically covers a much longer timeframe than temporary or short-term disability benefits do.